Highriskpay.com emerges as a revolutionary force in the high-risk merchant services landscape, offering a lifeline to businesses traditionally shunned by conventional payment processors.

This cutting-edge platform leverages advanced AI-driven risk assessment algorithms and blockchain technology to provide secure, efficient payment solutions for industries ranging from cryptocurrency exchanges and online gaming to nutraceuticals and subscription-based services.

By employing a sophisticated multi-layered approach to fraud prevention and chargeback management, Highriskpay.com not only mitigates risks but also empowers high-risk merchants to scale their operations with confidence in an increasingly digital marketplace.

What is the Reason for You to Require High Risk Merchant Highriskpay.com?

Businesses may require Highriskpay.com’s services when they face difficulties obtaining merchant accounts through conventional channels.

This often occurs due to factors such as operating in industries with higher chargeback rates regulatory challenges or a history of financial instability. Highriskpay.com steps in to provide these merchants with the ability to process payments and maintain their operations.

Advantages of Having a High Risk Merchant Highriskpay.com

Utilizing Highriskpay.com offers several key benefits for high-risk merchants. First it provides access to payment processing services that might otherwise be unavailable.

Second Highriskpay.com offers specialized risk management tools to help mitigate the unique challenges faced by high-risk businesses.

Additionally their expertise in handling high-risk transactions can lead to improved approval rates and more stable processing relationships.

Characteristics of High Risk Merchant Highriskpay.com

Highriskpay.com distinguishes itself through several key characteristics. They offer robust fraud prevention measures tailored to high-risk industries. Their platform is designed to handle higher chargeback ratios effectively.

Highriskpay.com also provides more flexible underwriting criteria allowing businesses that might be rejected elsewhere to obtain merchant accounts. Their customer support is specialized in addressing the unique concerns of high-risk merchants.

What do High-Risk Payment Processors entail?

High-risk payment processors like Highriskpay.com are financial service providers that specialize in handling transactions for businesses deemed high-risk.

They employ advanced risk assessment tools use more stringent security measures and often have higher reserve requirements.

These processors are equipped to manage the increased likelihood of chargebacks and fraud associated with high-risk industries.

Do you need to have High Risk Merchant Highriskpay.com?

Determining whether you need Highriskpay.com depends on several factors. If your business operates in an industry traditionally considered high-risk such as online gambling adult entertainment or certain types of subscription services you may benefit from their specialized services.

Additionally if you’ve been denied merchant accounts by traditional providers or struggle with high chargeback rates Highriskpay.com could be a suitable solution.

Read This Blog: Why Am I Getting a Package from Auctane ShipStation?

How does one go about opening a high-risk merchant account?

Opening a high-risk merchant account with Highriskpay.com involves a straightforward process. First you’ll need to submit an application providing details about your business including its financial history and the nature of your products or services.

Highriskpay.com will then conduct a risk assessment. If approved you’ll receive terms tailored to your business’s risk profile. The process typically involves more thorough vetting than traditional merchant accounts but Highriskpay.com strives to make it as smooth as possible.

Contrasting High-Risk and Low-Risk Merchant Accounts

High-risk merchant accounts like those provided by Highriskpay.com differ from low-risk accounts in several ways. High-risk accounts often come with higher processing fees to offset the increased risk.

They may also require rolling reserves where a portion of transactions is held temporarily as a security measure. Low-risk accounts typically have lower fees and fewer restrictions but are not available to businesses in industries deemed high-risk.

What Industries Does Highriskpay.com Serve That Are Considered High Risk?

Highriskpay.com serves a wide range of industries typically considered high-risk. These include online gaming and gambling platforms adult entertainment websites subscription-based services travel and tourism businesses cryptocurrency exchanges and forex trading platforms.

They also cater to nutraceutical companies online pharmacies and businesses selling age-restricted products. Highriskpay.com’s expertise extends to emerging industries that traditional financial institutions might be hesitant to serve.

Read This Blog: Unleashing Wordle: Tom’s Guide Hints, Strategies, and Daily Updates

Various Kinds of High-Risk Merchant Accounts Provided by Highriskpay.com

Highriskpay.com offers a variety of high-risk merchant account types to suit different business needs. These include e-commerce accounts for online retailers offshore accounts for international businesses and multi-currency accounts for those dealing in various currencies.

They also provide specialized accounts for specific high-risk industries such as gaming merchant accounts or adult entertainment payment solutions. Each account type is tailored to address the unique challenges and requirements of its respective industry.

High Risk Merchant Highriskpay.com’s Area of Expertise

Highriskpay.com’s expertise lies in navigating the complex landscape of high-risk payment processing. They excel in risk assessment and management developing customized solutions for businesses that struggle with traditional providers.

Their team is well-versed in regulatory compliance across various high-risk industries ensuring that their clients can operate within legal frameworks. Highriskpay.com’s proficiency extends to chargeback prevention and fraud detection crucial skills in the high-risk sector.

Efficient ACH Processing

Highriskpay.com offers efficient Automated Clearing House (ACH) processing as part of its services. This allows businesses to process electronic bank-to-bank transfers quickly and securely.

For high-risk merchants ACH processing through Highriskpay.com can provide an alternative or complement to credit card transactions potentially reducing processing fees and expanding payment options for customers.

Swift Application Approval

One of Highriskpay.com’s strengths is its swift application approval process. Understanding the urgency often faced by high-risk businesses they’ve streamlined their vetting procedures without compromising on thoroughness.

This allows merchants to start processing payments quickly crucial for maintaining business continuity especially for those who may have recently lost their previous processing capabilities.

Effective Chargeback Prevention Program

Highriskpay.com implements a robust chargeback prevention program to protect its merchants. This includes real-time monitoring of transactions alerts for suspicious activity and tools to help merchants dispute illegitimate chargebacks.

They also provide education and best practices to help businesses reduce their chargeback rates proactively. This comprehensive approach helps high-risk merchants maintain healthier processing relationships and avoid account terminations due to excessive chargebacks.

Engaging in the Risky Business: The Necessity of a High-Risk Merchant Account

For many businesses operating in high-risk industries a specialized merchant account like those offered by Highriskpay.com is not just beneficial—it’s necessary. Without such accounts these businesses may find themselves unable to process payments effectively limiting their growth and potentially threatening their existence.

Highriskpay.com’s services enable these merchants to operate on a level playing field accepting payments and growing their businesses despite their high-risk classification.

What does a High Merchant Category Risk entail?

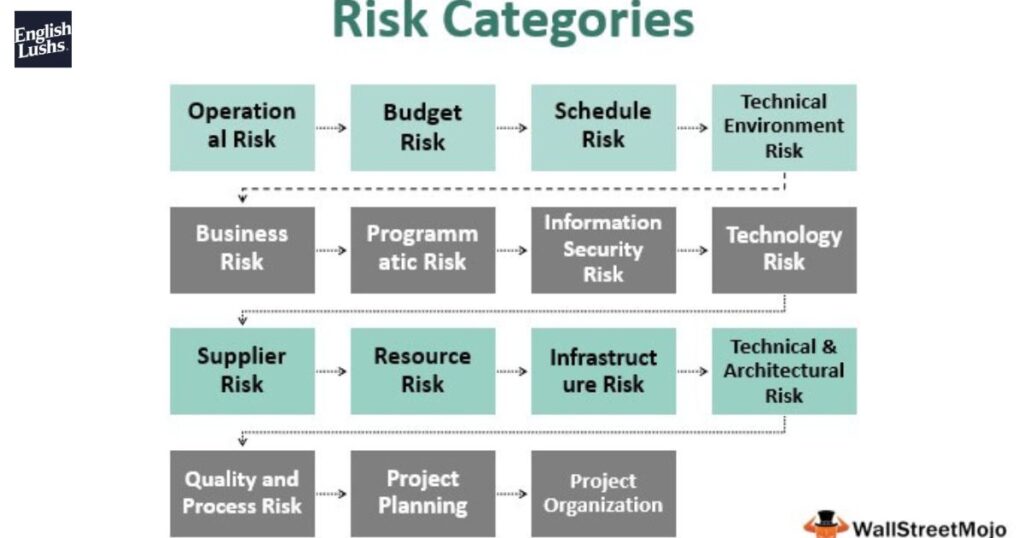

A High Merchant Category Risk refers to businesses operating in industries that payment processors and banks consider more likely to incur financial losses.

This classification is based on factors such as higher rates of chargebacks fraud or regulatory scrutiny. Highriskpay.com specializes in serving these high-risk categories providing tailored solutions to manage the associated risks effectively.

Credit card processor specializing in high-risk transactions

As a credit card processor specializing in high-risk transactions Highriskpay.com offers a range of services designed to meet the unique needs of high-risk merchants.

They provide secure payment gateways robust fraud detection systems and specialized underwriting processes. Their expertise in high-risk processing allows them to offer competitive rates and terms even for businesses that might be rejected by traditional processors.

Payment gateway designed for high-risk transactions

Highriskpay.com’s payment gateway is specifically designed to handle the complexities of high-risk transactions. It incorporates advanced security measures to protect against fraud and data breaches.

The gateway supports multiple payment methods and currencies catering to the diverse needs of high-risk businesses. It also integrates seamlessly with various e-commerce platforms making it easy for merchants to implement and use.

Customer-Focused Approach of HighRiskPay.com the High-Risk Merchant

Highriskpay.com prides itself on its customer-focused approach. They understand the challenges faced by high-risk merchants and strive to provide personalized solutions.

Their customer support team is knowledgeable about high-risk industries and available to assist with any issues that may arise. Highriskpay.com also offers educational resources to help merchants optimize their payment processing and reduce risks.

Championing Financial Inclusivity: HighRiskPay.Com’s Dedication to Empowering the Underbanked

Highriskpay.com is committed to promoting financial inclusivity by providing services to businesses that might otherwise be excluded from the financial system. They work with merchants in emerging markets and industries often overlooked by traditional financial institutions.

By offering payment processing solutions to these underserved sectors Highriskpay.com plays a crucial role in fostering economic growth and innovation in diverse areas of the global economy.

Achieving Success in FinTech History: Going Beyond the Limits of Risk

Highriskpay.com’s success story in the FinTech industry is one of innovation and resilience. By specializing in high-risk merchant services they’ve carved out a unique niche in the market.

Their ability to adapt to changing regulatory landscapes and evolving risk profiles has allowed them to thrive where others have hesitated. Highriskpay.com’s journey demonstrates how embracing risk with the right expertise and technology can lead to significant achievements in the financial services sector.

Other Options Besides High Risk Merchant Highriskpay.com

While Highriskpay.com offers comprehensive solutions for high-risk merchants there are alternatives available. Some businesses may explore options such as offshore merchant accounts cryptocurrency payment systems or peer-to-peer lending platforms.

However it’s important to note that these alternatives often come with their own set of challenges and may not provide the same level of security and reliability as Highriskpay.com’s specialized services.

Frequently Asked Questions

What types of businesses are considered high-risk?

High-risk businesses typically include online gambling adult entertainment subscription services travel agencies and industries with high chargeback rates or regulatory challenges.

How long does it take to get approved for a high-risk merchant account with Highriskpay.com?

Approval times can vary but Highriskpay.com strives for swift processing often providing initial responses within 24-48 hours.

Are Highriskpay.com’s services more expensive than traditional merchant accounts?

While fees may be higher due to increased risk they are competitive within the high-risk processing market and often more affordable than alternatives for high-risk merchants.

Can Highriskpay.com help businesses with a history of chargebacks?

Yes Highriskpay.com specializes in helping businesses manage and reduce chargebacks offering tools and strategies to mitigate this risk.

Does Highriskpay.com offer services internationally?

Yes Highriskpay.com provides international payment processing solutions including multi-currency accounts for global businesses.

Final Thought

Highriskpay.com stands as a crucial pillar in the high-risk merchant services industry offering a lifeline to businesses that might otherwise struggle to process payments.

Their specialized approach combines robust risk management with a deep understanding of the unique challenges faced by high-risk merchants.

By providing tailored solutions efficient processing and dedicated support Highriskpay.com enables businesses in diverse high-risk sectors to thrive and grow.

As the financial landscape continues to evolve Highriskpay.com’s role in fostering financial inclusivity and innovation becomes increasingly significant.

Amelia is a skilled SEO expert with a strong focus on content writing, keyword research, and web development. With a dedication to delivering results, she helps businesses optimize their online presence and drive organic growth.

Her expertise ensures that clients stay ahead in the ever-evolving digital landscape